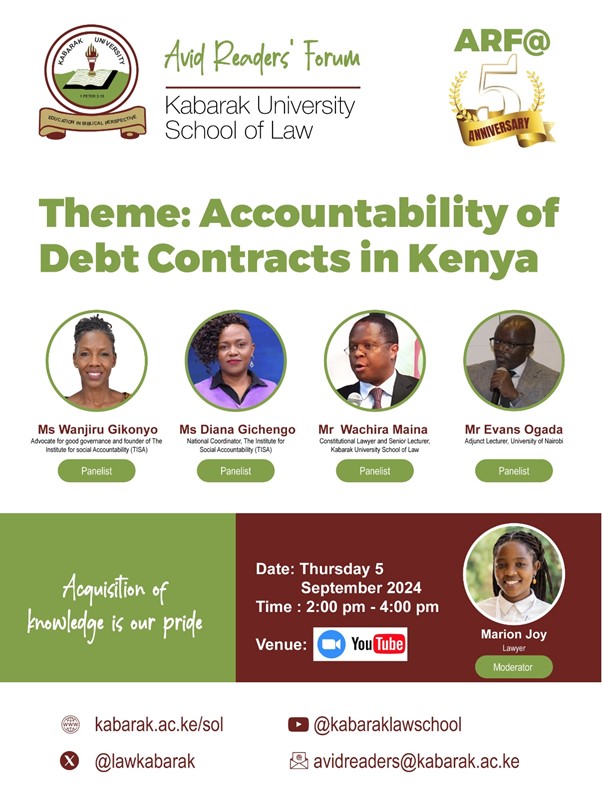

On Thursday, September 5, 2024, the Avid Readers Forum hosted a momentous webinar for its fifth-anniversary celebrations. In partnership with Ms Wanjiru Gikonyo, the webinar focused on the accountability of debt contracts in Kenya and was part of a series of discussions on public finance accountability. The discussion centred on the increasing national debt and a constitutional petition by the Kenya Human Rights Commission and The Institute of Social Accountability (TISA) cited as Kenya Human Rights Commission & Wanjiru Gikonyo-V-CS National Treasury and Planning & Attorney General (Constitutional Petition/E179/2022), challenging the government's failure to disclose public debt information and emphasizing the importance of accountability in debt procurement and management.

The main discussants, each a respected figure in their respective fields, were Mr Evans Ogada, an Adjunct Lecturer of Law at the University of Nairobi and Advocate of the High Court of Kenya; Ms Diana Gichengo, a well-known human rights activist currently working at TISA as the National Coordinator while at the time of instituting this case, she was at the Kenya Human Rights Commission; and Ms Wanjiru Gikonyo, an advocate for constitutionalism and a supporter of participatory devolved governance. Marion Joy Ochangwa, a lawyer and Graduate Intern at Kabarak Law School, moderated the discussion.

The discussions

Ms Wanjiru Gikonyo started the conversation by addressing the current debt issue in Kenya, presenting it as a political issue coupled with corruption rather than solely a legal issue. Thus, despite prescriptive legislation, there is no political goodwill on the accountability of debt contracts. She emphasised the need for institutional accountability, suggesting that greater involvement from entities like Parliament might be necessary. In addition, she highlighted that if bodies like Parliament fail to fulfill their obligations in essential areas like public finance, citizens have other options to pursue, such as public interest litigation in courts, exercising their rights to protest, and submitting petitions.

Ms Wanjiru Gikonyo started the conversation by addressing the current debt issue in Kenya, presenting it as a political issue coupled with corruption rather than solely a legal issue. Thus, despite prescriptive legislation, there is no political goodwill on the accountability of debt contracts. She emphasised the need for institutional accountability, suggesting that greater involvement from entities like Parliament might be necessary. In addition, she highlighted that if bodies like Parliament fail to fulfill their obligations in essential areas like public finance, citizens have other options to pursue, such as public interest litigation in courts, exercising their rights to protest, and submitting petitions.

Mr Evans Ogada expanded on the legal foundations of the petition, pointing out that it draws from Kenya s Constitution, particularly the Preamble, which reflects the values of the Kenyan people. He highlighted key constitutional provisions, including Articles 1, 2, 3, and 10, emphasizing sovereignty, constitutional supremacy, and the principles of good governance. He also referenced Chapter 6 on Leadership and Integrity, Article 201 on public finance principles, and the Access to Information Act as crucial in regulating debt transparency. He argued that public participation in governance is essential, and access to information empowers citizens to hold the government accountable.

Ms Diana Gichengo highlighted the importance of linking human rights and debt contracts while advocating for increased accountability. She emphasized the state's obligation to promote, protect, and fulfill human rights as stated in Article 21 of the Constitution. She stressed that the state's obligations extend to socio-economic rights outlined in Article 43 of the Constitution, emphasizing that these rights can only be realized with sufficient financial resources. She pointed out that excessive debt servicing negatively impacts finances and budget allocations for essential services such as health and education, limiting the realization of people's rights. For instance, allocations that could have been used for health and education are redirected to debt servicing. Therefore, she urged greater accountability in debt contracts and financing to guarantee people's rights. Furthermore, while advocating for greater accountability, she emphasized responsible borrowing in line with domestic laws and criticized Parliament for insufficient oversight of debt servicing.

The audience, actively engaged in the discussion, raised several important concerns. One participant questioned the conflict between confidentiality clauses in debt contracts and the constitutional requirement for openness and transparency. Mr Ogada responded that confidentiality cannot override statutory obligations, and the state must justify non-disclosure. Another question addressed the concept of odious debts. Mr Ogada explained that while it has not yet evolved into a legal principle, it could be a future remedy for holding officials accountable for unconstitutional debts. Concerns were also raised about enforcing court orders, with the discussants emphasizing the importance of continued advocacy and activism despite challenges.

Conclusion

In conclusion, the panel underscored that effectively addressing the issue of public debt in Kenya requires a comprehensive strategy that includes legal frameworks, active public involvement, and strong institutional oversight. They unanimously agreed that governance based on democratic principles is crucial to maintaining transparent debt management practices. They also stressed the importance of fostering collaboration among key stakeholders, such as government bodies, financial institutions, and civil society, to promote greater accountability. Ultimately, it was stressed that citizens must remain vigilant and continue to advocate for responsible borrowing and spending to protect Kenya's future.